How to Link your AADHAR and PAN when your have Name Mismatch

The IT department of India has made it mandatory to link AADHAAR number to your PAN, in order to file your Income Tax. This has to be done latest by 31st March 2019. Since the AADHAAR-PAN linking is an automated seeding process (which works through API), it will fail if there is a small mismatch of data. E.g. if your name is

I have created a small and crisp 5 step how-to guide to link your Aadhaar to your PAN, in

Follow the below easy steps to Link your AADHAAR number to your PAN

Step 1: Go to the following link

https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/LinkAadhaarHome.html.

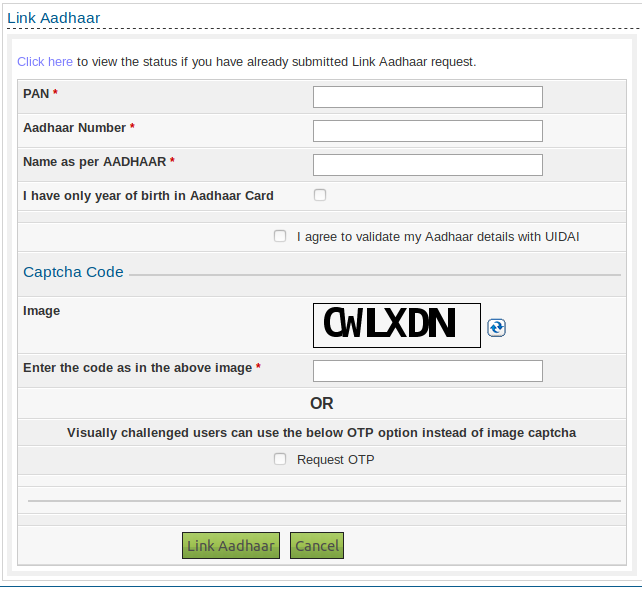

You will see a form as shown below

Step 2: Enter your PAN in the first box and your AADHAAR number in the next box. Now, in the next box, enter your name exactly printed on your AADHAAR.

Step 3: Next there is a checkbox. Check this, only if your AADHAAR has only your birth of year and not the complete date of birth. Skip it otherwise. You have to check the next checkbox which says I agree to validate my Aadhaar details with UIDAI. Otherwise, you cannot proceed further.

Step 4: Now, in the last box, enter the text shown in the image just above the box. If you are visually challenged and having

Step 5: After entering all the data correctly click on the Link Aadhaar button. You will receive an OTP on the mobile number if you have checked the Request OTP box. Enter it in the box shown next. Click on the Link Aadhaar button. You will see a confirmation message as shown in the picture below

Done! If everything is proper, your PAN will be linked to AADHAAR in sometime.

Hope this small guide would help you in linking your Aadhar to your PAN. Since the Aadhaar-PAN linkage is made mandatory by IT department, you should do it right away, if you file your income tax online.

Should you have any queries, ask through the comments.

Keep sharing, because sharing is caring 🙂

Very useful information thanks

Same process i have tried but im getting name mismatch error through sms

Sneha, if you follow the steps appropriately, the linking should be successful. Your name in the PAN database may not be exactly as printed on your PAN card. If you account already on the income tax portal, please refer that for the exact name. Feel free to reply here if you still face the same issue.

I have only first name in all my documents and aadhar but in my pan card my first name and surname are both Can I drop my surname in pan card ?

Yes, you can change the printed name on your PAN by submitting an application for PAN correction and select only printed name correction.

Hi, My aadhaar and PAN both names are correct but i am getting the error like NAME MISMATCH , How to resolve it ?

You will only get that error of the names are really not matching. As I have mentioned earlier here, your printed name on the PAN card might be matching with the name on the AADHAAR, but your name in the PAN database might be different. If your name on AADHAAR is the correct one, I would suggest you get your PAN updated with AADHAAR verification method.

But what if the spelling is wrong in adhaar but correct in pan?

As per the latest information available, you need to get your information corrected in Aadhaar first.

Hello, Mr Vishal.

I have the exact same name in both PAN and Aadhar, but it has still given me the name-mismatch error. any idea how to proceed?

i visited an Aadhar centre but they were not helpful.

The name printed on the PAN card may not be the name you actually have in the record. I have the same problem (however, I have linked my PAN AADHAAR long back with available options). My name in PAN record is something like [FIRSTNAME][FATHERSNAME][LASTNAME] and printed name on PAN card is [FIRSTNAME][LASTNAME] which is matching with my AADHAAR name [FIRSTNAME][LASTNAME]. However, I was still not able to link it directly.

The solution for you: If your AADHHAR name is correct, get your PAN card updated with correct name (you can do it online using AADHAAR easily if you have your mobile number registered in AADHAAR and you have access to it). Post that, you can link it without any hassle.